Legislation To Get People Back To Work

State Representative Gong-Gershowitz has filed the RISE Act. This legislation will get people back to work and support small businesses. The RISE Act (House Bill 0801) creates a tax incentive for businesses that retrain and hire employees who have lost their jobs or businesses because of the pandemic.

Businesses with under 500 employees will receive a $2,500.00 tax credit for retraining and hiring a new employee. Businesses with under 100 employees will receive a $5,000.00 tax credit. An additional tax incentive of $500.00 will be provided if the business is in a disproportionately impacted area (DIA) or if the person being hired resides in a DIA.

Getting people back to work will replace unemployment payments with tax revenue. It will support small businesses and stimulate the economy. Most importantly, this will get people back to work.

Please take action below to contact your legislators and ask them to sponsor the RISE Act! It only takes a moment!

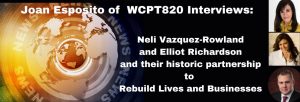

SBAC and A Safe Haven on WCPT Chicago

Elliot Richardson and Neli Vasquez-Rowland on WCPT with Joan Esposito On December 3rd, Elliot Richardson, President and Co-Founder of SBAC and Neli Vasquez-Rowland, Founder and President of A Safe Haven were hosted on WCPT Chicago with Joan Esposito discussing the situation of homelessness and small businesses in Chicago. With the pandemic affecting small businesses on…

Congress Must Provide Relief to Local Chambers and Business Organizations

Congress Must Provide Relief to Local Chambers and Business Organizations Local chambers of commerce and business organizations provide crucial support to the small business community. It is imperative that Congress provide them with the support needed so they can make it through these unprecedented times and help local businesses recover from the pandemic. Over 50…

Home Based Businesses

Jumpstarting Chicago’s Economic Recovery The city of Chicago is facing unprecedented public health and economic challenges resulting from COVID-19. By executive order, by choice, or by necessity, many Chicagoans are starting and operating businesses from home during the pandemic. However, Chicago’s regulations make the home occupation license too complicated and too restrictive for these vitally…