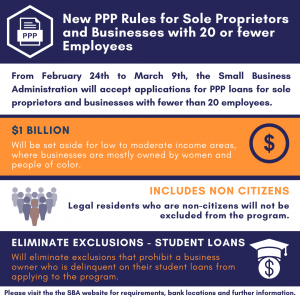

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Congrats to Patti & Her Team!

DONATE Congrats Patti! Patti is one of the recipients of the Best Networking Mentor award from Networlding! From their LI post: These mentors will now join a vibrant community focused on aiding new adults in kick-starting their careers. Building on the success of my 2002 networking contest, we aim to recreate that magic. Stay tuned…

Congrats to our Founder Scott Baskin!

DONATE Congrats Scott! Scott has been appointed to the Illinois Health Benefits Exchange Advisory Committee: a committee charged with helping implement the Illinois Health Benefits Exchange to provide affordable health care options for individuals and small businesses. This is due to Scott and the SBAC’s hard work passing a law about this back in 2023.…

Larger Tax Credits for Hiring Formerly Incarcerated Individuals

Download PDF here SBAC INSIGHTS PAGE Illinois Policymakers Take Bold Action to Support Businesses and Foster Opportunities for Formerly Incarcerated Individuals Press Release SBAC INSIGHTS PAGE