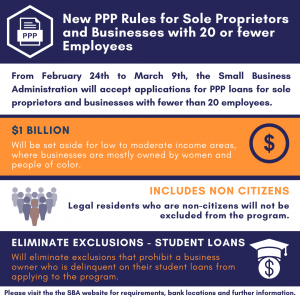

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

NRC Community Survey Has Been Extended!

Thriving commercial corridors and neighborhood business districts can support local communities across Chicago and Cook County. However, many commercial corridors are struggling. We are looking for your feedback and insight on how to revitalize and empower commercial corridors. Please take a moment to fill out this short survey so we can better understand the needs…

SUPPORT NEIGHBORHOOD BUSINESS DISTRICTS

SUPPORT NEIGHBORHOOD BUSINESS DISTRICTS BY REDUCING COMMERCIAL VACANCIES Struggling neighborhood business districts are often plagued by vacant properties. These commercial vacancies impact local economies, foster criminal activity and devastate communities. Local governments can reduce the property taxes owed by commercial property owners when their properties, or a portion of those properties, are vacant. While most…

SBAC Business Buzz – January 2022

SBAC Business Buzz – January 2022 Welcome to the inaugural episode of our new video series, SBAC Business Buzz, featuring Elliot Richardson’s update on SBAC initiatives impacting the Illinois small business community. Today’s 3-minute recap focuses on Back to Business Grants, Workforce, Occupational SPONSORS Fifth Third Bank Saul Ewing Arnstein Lehr Inland Bank Ntiva Daily…