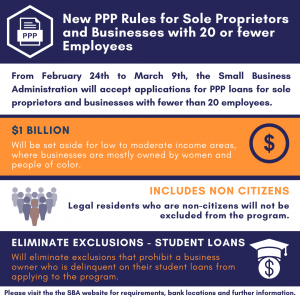

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Press Release – Chicago’s Cut Red Tape Agenda

Chicago’s Cut Red Tape Agenda March 2, 2021 FOR IMMEDIATE RELEASE Contact: Elliot Richardson // 847-380-4900 // Elliot@sbacil.org Cutting unnecessary and burdensome red tape will help Chicago’s small and local businesses recover from the pandemic. Much of this red tape should have been eliminated long ago. The Small Business Advocacy Council and a coalition of…

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees. The move is meant to make it easier for businesses with few or no employees –…

ACTION CALL! Legislation To Get People Back To Work

Legislation To Get People Back To Work State Representative Gong-Gershowitz has filed the RISE Act. This legislation will get people back to work and support small businesses. The RISE Act (House Bill 0801) creates a tax incentive for businesses that retrain and hire employees who have lost their jobs or businesses because of the pandemic.…