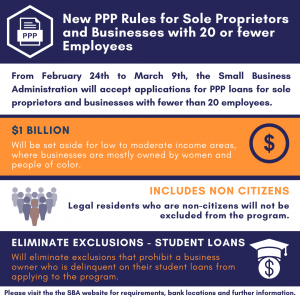

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Ordinance Makes It Easier for Entrepreneurs to Operate Home-Based Businesses in Chicago

The pandemic has cost Chicagoans jobs and recently unemployed individuals may explore starting their own business. However, these budding entrepreneurs may not have the funds to rent space. Indeed, even more established entrepreneurs may need to consider moving their businesses into a residence for the time being given the economic impact of the pandemic. This is…

Crucial Legislation Filed to Get People Back to Work

RISE Action Call – SIGN HERE PRESS RELEASE: CHICAGO, ILLINOIS, UNITED STATES, February 22, 2021 /EINPresswire.com/ — Representative Jennifer Gong-Gershowitz has filed the RISE Act in the General Assembly. The Small Business Advocacy Council (SBAC) urges legislators to pass the RISE Act (Recovery Initiative to Support Employment) to get people back to work and support…

Business Interruption Insurance

WHAT IS BUSINESS INTERUPTION INSURANCE? The COVID-19 pandemic has had a devastating impact on individuals, families and communities. The pandemic is also causing tremendous financial hardship on small and local businesses. Typically, businesses will carry business interruption insurance to cover for potential extended closures caused by extraordinary circumstances. Competent business owners have done their due…