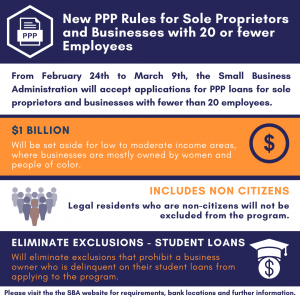

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

Home Based Businesses

Jumpstarting Chicago’s Economic Recovery The city of Chicago is facing unprecedented public health and economic challenges resulting from COVID-19. By executive order, by choice, or by necessity, many Chicagoans are starting and operating businesses from home during the pandemic. However, Chicago’s regulations make the home occupation license too complicated and too restrictive for these vitally…

Property Tax Reform

Citizens Empowerment Act The state of Illinois has the second highest property taxes in the US. Property taxes are a huge burden on Illinois residents and small businesses, and often drive people out of the state. Illinois also has 6,918 local units of government, according to the latest Census Bureau data, which is more than…