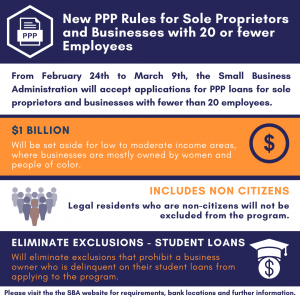

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees.

The move is meant to make it easier for businesses with few or no employees - sole proprietors, independent contractors, and self-employed people such as house cleaners and personal care providers - to apply that previously could not qualify due to business cost deductions.

In addition to the 2-week application period:

- $1 Billion will be set aside for low to moderate income areas, where businesses are mostly owned by women and people of color.

- Legal residents who are non citizens will not be excluded from the program.

- Will eliminate exclusions that prohibit a business owner who is delinquent on their student loans from applying to the program.

Please visit the SBA website for requirements, bank locations and further information.

PEACE OF MIND VIRTUAL ASSISTANCE

Peace of Mind Virtual Assistance has partnered with the Chicago area and US-based small business owners since 2003. Whether consulting, managing Operations, or C-level executive tasks we are here for you. We support easy to work with, ethical, fun, established professional service solo entrepreneurs (Attorneys, CFOs, creative firms, consultants, etc.) and businesses with teams of…

REGIMENT INVESTMENT BANK

The digital investment bank that utilizes reg-compliant marketplace technology to connect emerging entrepreneurs with earnest investors. At Regiment, our focus is two-fold… Raising capital from investors seeking non-traditional investment products. Funding early-stage companies and companies seeking capital for growth. but it’s our edge that sets us apart. Financial and technological expertise gives us an edge…

ROSCOE COMPANY

Count on us for the highest quality work uniforms and floor mats that elevate your brand, make your employees look great, maintains compliance, and ensures safety. Better ideas lead to better customer service. From automated sorting equipment to computerized garment tracking systems, Roscoe Takes Pride in helping you Take Pride in your company image –…