BIG LEGISLATION FOR SMALL BUSINESSES

President Biden has signed The American Rescue Plan Act (H.R 1319) into law. Accordingly, the State of Illinois is expected to receive $7.549 billion in funds to foster recovery from the COVID-19 pandemic.

A robust coalition of small business advocates are asking that Governor Pritzker and lawmakers allocate 25% of those relief funds to help small and local businesses recover from the pandemic. The Illinois small business community has been devastated by the COVID-19 pandemic.

We strongly urge Governor Pritzker and Illinois lawmakers to:

- Provide $10,000 grants to small businesses (50 or less employees) with revenue of $100,000 that can demonstrate a 25% reduction in gross revenue between 2019 and 2020. Businesses in disadvantaged communities will receive an additional $2,500 in funding.

- Offer small businesses whose revenue did not exceed $100,000 in 2019 with grants totaling 10% of the revenue loss the business sustained between 2019 and 2020. Businesses in disadvantaged communities will receive an additional 2.5% of lost revenue.

- Provide $2,500 grants to eligible small businesses which launched in the 3rd and 4th quarter of 2019 and as such, are not able to demonstrate the requisite loss in revenue from 2019 to 2020. Businesses in disadvantaged communities will receive an additional $500 in funding.

- These businesses must meet three out of the following criteria before March of 2020:

- A website or social media presence

- Office space

- Have a business banking account

- $10,000 in revenue

- At least one full time Employee

We urge Governor Pritzker and Illinois lawmakers to ensure that businesses that did not receive prior BIG grants have priority over those which did receive said grants. PPP loans and other such revenue should not be counted as revenue in determining the eligibility of businesses.

Endorsed By:

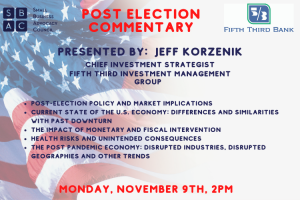

SBAC and Fifth Third Bank Present: Post Election Commentary by Jeff Korzenik

A Post Election Commentary Presented by: Jeff Korzenik Managing Director, Chief Investment Strategist, Fifth Third Investment Management Group Discussion Points: Post-Election Policy and Market Implications Current State of the U.S. Economy: Differences and Similarities with Past Downturns The Impact of Monetary and Fiscal Intervention Health Risks and Unintended Consequences The Post Pandemic Economy: Disrupted Industries, Disrupted…

Graduated Income Tax Town Hall Recording 9/24/2020

The resounding success of our last Graduated Income Tax Town Hall has prompted the IACCE and SBAC to partner on a follow-up forum. Ralph Martire and Leslie Munger returned to answer your questions about the proposed graduated income tax. Ralph Martire is the Executive Director for the Center for Tax and Budget Accountability and Rubloff Professor…

R.I.S.E. Act

READ HB-0801 HERE READ SB-2490 HERE TAKE ACTION Recovery Initiative to Support Employment Small businesses in many industries are struggling and as a result, have no choice but to layoff valued employees. Entrepreneurs and independent contractors in the fields most impacted by the pandemic are also losing their businesses. The COVID-19 pandemic has been unforgiving…