The REST Act Supports Small Businesses! (H.R.3725)

The SBAC is strongly supporting legislation filed by Representative Newman designed to cut taxes on entrepreneurs and small businesses across the country. The Relief and Equity for Small Businesses through Tax (REST) Act adjusts Section 199A of the Internal Revenue Code to increase the deduction of qualified business income from 20% to 25% for business owners making less than $100,000 in taxable annual income.

Simply put, this means entrepreneurs that generate less than $100,000 in income will pay fewer taxes so they can grow their businesses.

Read Congresswoman's Marie Newman's Press Release HERE.

5/3 Bank – Informational Articles

Fifth Third Bank – Commitment to Small Business SBAC partner Fifth Third Bank is committed to the success of small businesses. Because “small” is a misnomer for driving the economy and creating jobs in local communities as they have a “big” impact. Fifth Third partners with small businesses to provide the lending, lines of credit,…

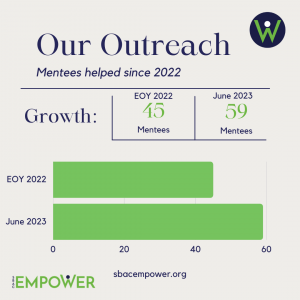

Empower Stats!

Empower has been working hard… Over the past 6 months, our mentoring program has blossomed; we’ve been able to help so many Small Businesses! Since January 2023, we’ve seen a 31% increase in our outreach to those in need of help. As proud of we are as our growth, we’re even more proud of our…

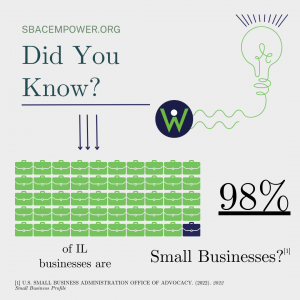

Stats for Small Businesses

IL Small Businesses, Did you Know…. Did you know that according to the Illinois Small Business Association, a bit over 98% of the businesses within Illinois are Small Businesses? That means statistically, you can probably name most of the larger IL businesses off the top of your head! So, if you approach a store on…