The REST Act Supports Small Businesses! (H.R.3725)

The SBAC is strongly supporting legislation filed by Representative Newman designed to cut taxes on entrepreneurs and small businesses across the country. The Relief and Equity for Small Businesses through Tax (REST) Act adjusts Section 199A of the Internal Revenue Code to increase the deduction of qualified business income from 20% to 25% for business owners making less than $100,000 in taxable annual income.

Simply put, this means entrepreneurs that generate less than $100,000 in income will pay fewer taxes so they can grow their businesses.

Read Congresswoman's Marie Newman's Press Release HERE.

Welcome Our New BOD Member!

Welcome Sherry Jursa! We’re happy to welcome Sherry Jursa from PNC‘s Business Banking wing to the Empower Board. Sherry holds an MBA from Northern Illinois University and a BA from North Central College in Political Science. With over 15 years’ experience in banking, Sherry is a proven professional who strives to provide excellence while meeting…

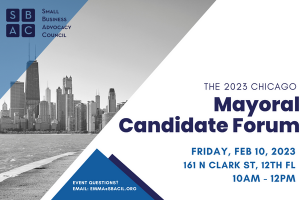

Small Business Mayoral Forum

SPONSORS Fifth Third Bank Saul Ewing Arnstein Lehr Inland Bank Interprenet Signature Bank Lexitas Korey Richardson Open One Solutions Byline DoorDash RockyTop Insperity SpeedPro Chicago Loop CVS

Legislation to Support Local Chambers Passes

Many chambers of commerce were devastated by the pandemic. However, this did not stop them from providing crucial support to local businesses. The SBAC is thrilled to report that Illinois politicians have provided 5 million dollars to support the recovery of chambers of commerce in Illinois. The SBAC has been working to procure this funding…