The REST Act Supports Small Businesses! (H.R.3725)

The SBAC is strongly supporting legislation filed by Representative Newman designed to cut taxes on entrepreneurs and small businesses across the country. The Relief and Equity for Small Businesses through Tax (REST) Act adjusts Section 199A of the Internal Revenue Code to increase the deduction of qualified business income from 20% to 25% for business owners making less than $100,000 in taxable annual income.

Simply put, this means entrepreneurs that generate less than $100,000 in income will pay fewer taxes so they can grow their businesses.

Read Congresswoman's Marie Newman's Press Release HERE.

What 2021 Could Mean for Small Businesses

January 20, 2021 By Elliot Richardson Small Business Advisory Council SBAC President Elliot Richardson’s column discusses the Business and Economic Outlook Forum hosted by the Daily Herald Business Ledger. The piece highlights the need for legislation that provides financial resources for small businesses to retrain and hire Illinoisans who have lost their jobs or businesses…

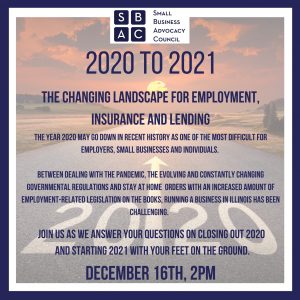

2020 to 2021 The Changing Landscape for Employment, Insurance and Lending

While mental health issues in the workplace have been a concern for some time, this past year, COVID-19 has shown the challenges employees are facing have spiked dramatically. Hear from Jason Tremblay on how this will impact both employers and their employees in the video. Stephen Ball from Fifth Third discusses automatic forgiveness for PPP…

Univision entrevista a Neli Vasquez-Rowland

Muchas gracias a univision para su reportaje sobre nuestra campaña conjunta con a Safe Haven Foundation para mantener a las pequenas empresas aflote y para prestar asistencia a las personas mas necesitadas durante este periodo tan dificil.