The REST Act Supports Small Businesses! (H.R.3725)

The SBAC is strongly supporting legislation filed by Representative Newman designed to cut taxes on entrepreneurs and small businesses across the country. The Relief and Equity for Small Businesses through Tax (REST) Act adjusts Section 199A of the Internal Revenue Code to increase the deduction of qualified business income from 20% to 25% for business owners making less than $100,000 in taxable annual income.

Simply put, this means entrepreneurs that generate less than $100,000 in income will pay fewer taxes so they can grow their businesses.

Read Congresswoman's Marie Newman's Press Release HERE.

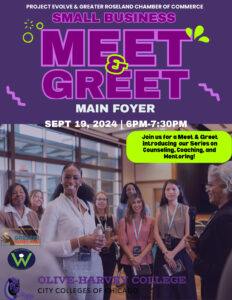

SBAC Empower and Greater Roseland Entrepreneurial Circle

DONATE An Exciting New Program for Small Businesses… Starting this September, the Greater Roseland Chamber of Commerce and SBAC Empower will be launching an incubator and joint mentoring program dedicated to helping both prospective small business owners and established small business owners in the Greater Roseland area. Each applicant will be assigned a specific cohort…

Congrats to Patti & Her Team!

DONATE Congrats Patti! Patti is one of the recipients of the Best Networking Mentor award from Networlding! From their LI post: These mentors will now join a vibrant community focused on aiding new adults in kick-starting their careers. Building on the success of my 2002 networking contest, we aim to recreate that magic. Stay tuned…

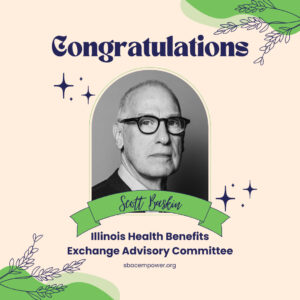

Congrats to our Founder Scott Baskin!

DONATE Congrats Scott! Scott has been appointed to the Illinois Health Benefits Exchange Advisory Committee: a committee charged with helping implement the Illinois Health Benefits Exchange to provide affordable health care options for individuals and small businesses. This is due to Scott and the SBAC’s hard work passing a law about this back in 2023.…