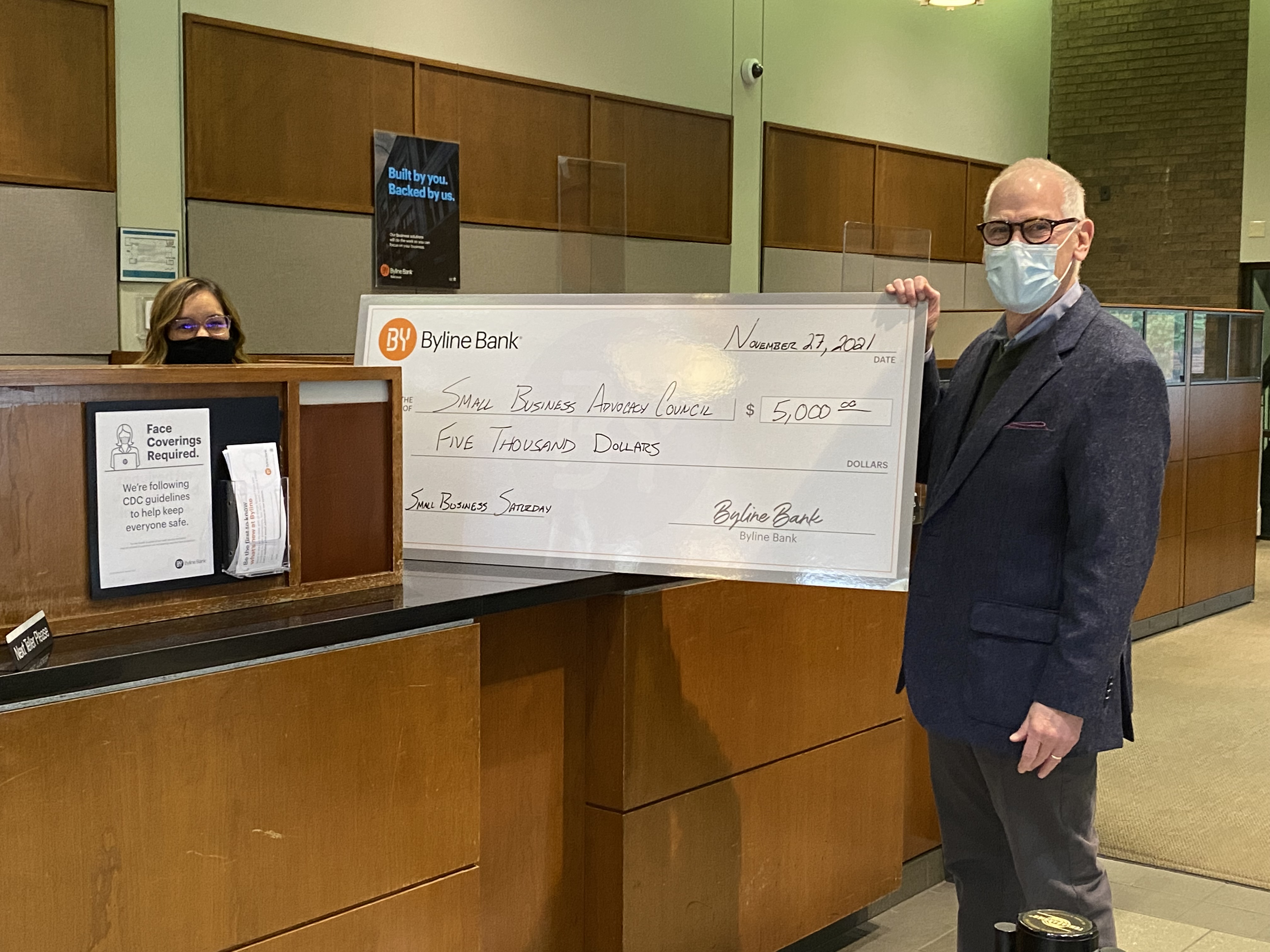

CHICAGO, IL (November 2021) – This Small Business Saturday, November 27, Byline Bank, Illinois’ top Small Business Administration lender, is recognizing the work of the Small Business Advocacy Council (SBAC) of Illinois with a $5,000 sponsorship contribution. The SBAC is a nonpartisan member-driven 501(c)(6) organization that advocates for reasonable policies that foster a healthier small business environment at the local, state and federal level.

“At Byline, we believe small businesses contribute to the vitality and future sustainability of our communities,” said Stephen Ball, Senior Vice President, Head of Business Banking, at Byline Bank and SBAC Executive Committee member. “After a uniquely challenging 18 months for small business leaders, the work of the SBAC is more crucial than ever, helping business owners voice their needs, concerns and ideas to policymakers in Chicago, Springfield and Washington.”

“We are grateful for the continued support of Byline Bank during the holiday season, which will be critical to the survival of many small businesses in Illinois,” said Elliott Richardson, Co-Founder and President of the Small Business Advocacy Council. “This $5,000 contribution and Stephen’s valuable role on our advisory board help support our fight for small businesses and local communities.”

It's no secret that small businesses unite the community. We are so thankful to have partners like @bylinebank who recognize the importance of small businesses everywhere. #ShopSmallSaturday #shoplocal #shopsmallbusiness https://t.co/C0os77tatE

— SBAC (@SBACIL) November 28, 2021

The SBAC Supports Relief For Chicago Small Businesses Through Reimbursement of Liquor License Fees

The SBAC supports a proposed Chicago ordinance which will reimburse small businesses a portion of the liquor license fees they paid because they could not use their license during pandemic related shutdowns. This ordinance will help many local businesses recover from the pandemic. Please translate this page to the language of your choice. Supporters Fifth…

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees

New PPP Rules for Sole Proprietors and Businesses with 20 or fewer Employees From February 24th to March 9th, the Small Business Administration will accept applications for PPP loans for sole proprietors and businesses with fewer than 20 employees. The move is meant to make it easier for businesses with few or no employees –…

Legislation to Help Black Owned Businesses Receive a Fair Share of State Contracts

READ H.B 2629 HERE TAKE ACTION Black Owned Businesses Deserve Access to Government Contracts Illinois has failed Black and African American owned businesses by failing to provide them access to state contracts. For too long, they have been denied a fair share of state contracts and revenue. Legislation has been filed to ensure Black and…

![BylineLogo_RGB[100003] BylineLogo_RGB[100003]](https://growthzonesitesprod.azureedge.net/wp-content/uploads/sites/1735/2021/09/BylineLogo_RGB100003-300x82.png)