One issue that has lead many to put off re-entering the workforce from the pandemic fallout is the cost and difficulty in terms of finding affordable and quality childcare. The SBAC has determined it is such a significant issue that it has been added to our agenda for the 2022 Spring Session.

The childcare tax credit will provide working families resources to offset the costs associated with childcare. To be eligible, households must jointly earn an annual income below $75,000 and have at least one child under the age of 17. Taxpayers that file individually must earn less than $45,000 and have one child under the age of 17.

Under this program, taxpayers shall receive a $1500 tax credit for the first child under age 17. An additional $500 will be allocated to each additional child under the age of 17 with a max payment of $2500 per family. This credit is intended to be used to offset the costs associated with childcare.

The program will be capped at $100,000,000 absent further appropriations. This tax credit will sunset in 2025 unless extended by the legislature.

Program Details:

- Tax credits for eligible working families to offset the costs of childcare

- Eligible families must earn:

- $75,000 or less filing jointly

- $45,000 or less filing individually

- Eligible families must also have at least one child under the age of 17

- Tax credit of $1500 for the first child under age 17

- $500 increase for each additional child under age 17

- The maximum allowable tax credit per family is $2500

- Program capped at $100,000,000

- Program to sunset in 2025

- Eligible families must earn:

What 2021 Could Mean for Small Businesses

January 20, 2021 By Elliot Richardson Small Business Advisory Council SBAC President Elliot Richardson’s column discusses the Business and Economic Outlook Forum hosted by the Daily Herald Business Ledger. The piece highlights the need for legislation that provides financial resources for small businesses to retrain and hire Illinoisans who have lost their jobs or businesses…

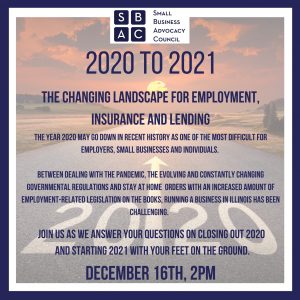

2020 to 2021 The Changing Landscape for Employment, Insurance and Lending

While mental health issues in the workplace have been a concern for some time, this past year, COVID-19 has shown the challenges employees are facing have spiked dramatically. Hear from Jason Tremblay on how this will impact both employers and their employees in the video. Stephen Ball from Fifth Third discusses automatic forgiveness for PPP…

Univision entrevista a Neli Vasquez-Rowland

Muchas gracias a univision para su reportaje sobre nuestra campaña conjunta con a Safe Haven Foundation para mantener a las pequenas empresas aflote y para prestar asistencia a las personas mas necesitadas durante este periodo tan dificil.