SUPPORT NEIGHBORHOOD BUSINESS DISTRICTS BY REDUCING COMMERCIAL VACANCIES

Struggling neighborhood business districts are often plagued by vacant properties. These commercial vacancies impact local economies, foster criminal activity and devastate communities.

Local governments can reduce the property taxes owed by commercial property owners when their properties, or a portion of those properties, are vacant. While most property owners that receive this tax break are legitimately attempting to sell, lease or improve their properties, others take advantage of this relief.

Legislation should be enacted to stop commercial property owners from receiving a tax break when they are not attempting to lease, sell or improve their spaces.

We support legislation that will do the following:

- Require property owners that receive a tax reduction to follow through on their promise to make legitimate attempts to sell, lease or improve their spaces

- Hold property owners who improperly receive a tax break at the expense of local communities and other taxpayers accountable

- Reduce commercial vacancies in neighborhood business districts

- Revitalize neighborhood business districts, create local jobs, and foster the growth of local economies

- Provide property owners legitimately attempting to sell, lease or improve their properties a tax reduction to offset losses associated with vacancy

There has never been a more important time to advocate for policies that will reduce vacancies in neighborhood business districts.

Endorsements:

Southeast Chicago Commission

Rogers Park Chamber of Commerce

Edgewater Chamber of Commerce

Six Corners Business Association

Pulaski Elston Business Association

Jefferson Park Chamber of Commerce

Building Strong Millennials

Gladstone Park Chamber of Commerce

Uptown United and Uptown Chamber of Commerce

Lincoln Park Chamber of Commerce

Logan Square Chamber of Commerce

Greater Englewood Chamber of Commerce

North Lawndale Chamber of Commerce

South Shore Chamber of Commerce

Lakeview Roscoe Village Chamber of Commerce

Rogers Park Business Alliance

Cook County Black Chamber of Commerce

Garfield Park Chamber of Commerce

Belmont-Central Chamber of Commerce

Woodlawn Chamber of Commerce

SBAC Empower and Greater Roseland Entrepreneurial Circle

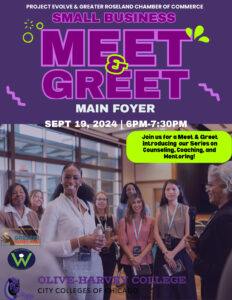

DONATE An Exciting New Program for Small Businesses… Starting this September, the Greater Roseland Chamber of Commerce and SBAC Empower will be launching an incubator and joint mentoring program dedicated to helping both prospective small business owners and established small business owners in the Greater Roseland area. Each applicant will be assigned a specific cohort…

Congrats to Patti & Her Team!

DONATE Congrats Patti! Patti is one of the recipients of the Best Networking Mentor award from Networlding! From their LI post: These mentors will now join a vibrant community focused on aiding new adults in kick-starting their careers. Building on the success of my 2002 networking contest, we aim to recreate that magic. Stay tuned…

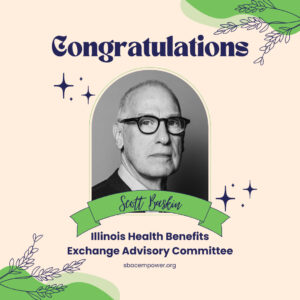

Congrats to our Founder Scott Baskin!

DONATE Congrats Scott! Scott has been appointed to the Illinois Health Benefits Exchange Advisory Committee: a committee charged with helping implement the Illinois Health Benefits Exchange to provide affordable health care options for individuals and small businesses. This is due to Scott and the SBAC’s hard work passing a law about this back in 2023.…