Illinois Policymakers Should Support Small Businesses

The pandemic and COVID-19 mitigations began inflicting immense damage to small businesses in March 2020. Thousands of small businesses initially applied for Illinois Business Interruption Grants. While these grants helped some small businesses, approximately 80% of applicants were not awarded a grant.

Illinois then received over $8 billion in American Rescue Plan Act funds. However, only $250 million was allocated to the new grant program for struggling small businesses. These funds will likely be exhausted before many eligible businesses receive grants. With billions of ARPA funds remaining, policymakers should allocate an additional $300 million for grants to struggling small businesses.

Illinois politicians should finish what they started. They should replenish the Back to Business grant program and promptly get funds to struggling small businesses, some of whom have waited almost two years for a grant to help offset the damage caused by the pandemic and mitigations established to curb the spread of COVID-19.

Please fill out the call to action below and ask your legislators to support struggling small businesses. Thank you for supporting the small business community!

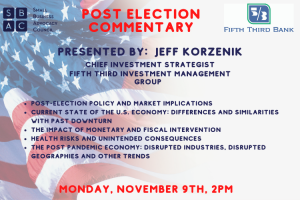

SBAC and Fifth Third Bank Present: Post Election Commentary by Jeff Korzenik

A Post Election Commentary Presented by: Jeff Korzenik Managing Director, Chief Investment Strategist, Fifth Third Investment Management Group Discussion Points: Post-Election Policy and Market Implications Current State of the U.S. Economy: Differences and Similarities with Past Downturns The Impact of Monetary and Fiscal Intervention Health Risks and Unintended Consequences The Post Pandemic Economy: Disrupted Industries, Disrupted…

Graduated Income Tax Town Hall Recording 9/24/2020

The resounding success of our last Graduated Income Tax Town Hall has prompted the IACCE and SBAC to partner on a follow-up forum. Ralph Martire and Leslie Munger returned to answer your questions about the proposed graduated income tax. Ralph Martire is the Executive Director for the Center for Tax and Budget Accountability and Rubloff Professor…

R.I.S.E. Act

READ HB-0801 HERE READ SB-2490 HERE TAKE ACTION Recovery Initiative to Support Employment Small businesses in many industries are struggling and as a result, have no choice but to layoff valued employees. Entrepreneurs and independent contractors in the fields most impacted by the pandemic are also losing their businesses. The COVID-19 pandemic has been unforgiving…