Click hereto see the SBAC in the news:

For media and PR inquiries, please contact River Strategies.

Email: Tslutzkin@riverstrategies.com

SBAC Insights Search

Insights Archive

Advocacy Insights

There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also costs the state money. It is time we take a pause to re-assess.

The Small Business Advocacy Council and IJ Clinic on Entrepreneurship are working together to pass legislation that will put a one-year pause on new occupational licenses. The bill also provides that more information will be made available for legislators before they decide on changing and enacting occupational licenses.

We look forward to working with bill sponsors Representative Michael Crawford and Senator Willie Preston on getting this legislation passed in 2025. We can protect the public without unnecessarily burdening entrepreneurs and stifling the workforce!

Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses' success. However, this year much more must be done to create a better climate for small and local businesses.

We strongly encourage Illinois politicians to include these among their New Year’s resolutions.

READ THE WHOLE ARTICLE HERE: Politicians should embrace these New Year’s resolutions

Shop Small, Shop Local: Support Chicago’s Neighborhood Businesses This Holiday Season

As the holiday season approaches, it’s time to consider the impact of where we shop. Supporting small, local businesses not only helps fuel Chicago’s economy but also strengthens our communities.

This year, make a commitment to shop small and explore the diverse businesses across our city. Whether you're searching for a unique gift, delicious holiday treats, or one-of-a-kind experiences, local shops offer something for everyone on your list.

To make holiday shopping even easier, check out Block Club Chicago’s Ultimate Guide To Shopping Local In Chicago For The Holidays 2024. This comprehensive guide allows you to shop by neighborhood, showcasing hundreds of gift ideas from local businesses across the city.

Let’s make this holiday season one of community, connection, and support for the small business owners who make Chicago vibrant!

Endorsed By:

Alderman Anthony Beale

Alderman Felix Cardona

Alderman Peter Chico

Alderwoman Angela Clay

Alderwoman Ruth Cruz

Alderman Derrick Curtis

Alderwoman Jessie Fuentes

Alderman James Gardiner

Alderwoman Maria Hadden

Alderman William Hall

Alderwoman Michelle Harris

Alderman Brian Hopkins

Alderwoman Leni Manaa-Hoppenworth

Alderman Tim Knudsen

Alderman Dan LaSpata

Alderman Bennett Lawson

Alderman Matt Martin

Alderwoman Emma Mitts

Alderman David Moore

Alderman Anthony Napolitano

Alderwoman Julia Ramirez

Alderman Carlos Ramirez-Rosa

Alderman Lamont Robinson

Alderman Mike Rodriguez

Alderman Byron Sigcho-Lopez

Alderman Nicholas Sposato

Alderwoman Silvana Tabares

Alderwoman Jeanette Taylor

Alderman Gilbert Villegas

Alderman Andre Vasquez

Alderman Scott Waguespack

Alderman Desmond Yancy

SBAC on the Move: Advocating for the Small Business Community

At the SBAC, we’re committed to ensuring that small businesses have a seat at the table regarding policymaking. Over the last few months, the SBAC has heavily engaged with policymakers and community leaders to advocate for small businesses. From forums to roundtables, we’ve connected with key decision-makers throughout Illinois. Our calendar of events is a great one-stop SBAC event page to stay connected and check out upcoming legislative events to attend.

Here’s a roundup of a few recent events:

Greater Wheeling Chamber Legislative Forum

The SBAC and the Greater Wheeling Area Chamber of Commerce hosted a community-driven legislative forum featuring key legislators. Among those present were Congressman Brad Schneider, State Senator Adriane Johnson, and State Representatives Mary Beth Canty, Daniel Didech, and Tracy Katz Muhl. Attendees could engage directly with lawmakers, ask questions, and share concerns on issues affecting their community and businesses.

Hospitality Industry Roundtable

Our team recently participated in the Illinois Restaurant Association's monthly roundtable to discuss small business trends in the restaurant business. State Representative Tracy Katz Muhl and Julie Morrison, along with employment attorney Robert Bernstein, were among the panelists opening up a discussion about key initiatives the SBAC is pursuing at both the city and state levels. Read more about the SBAC initiatives HERE.

Skokie Legislative Forum

The Skokie Chamber of Commerce invited the SBAC to moderate their annual event. SBAC President Elliot Richardson invoked a lively discussion between Illinois legislators and local business owners. Participants could ask questions and engage in meaningful dialogue about the future of small business advocacy in Illinois with Congresswoman Jan Schakowsky, Senator Villivallam, Senator Fine, Senator Jennifer Gong-Gershowitz, Skokie Chamber Executive Director Howard Meyer, Representative Kevin Olickal, Cook County Commissioner Josina Morita, and Senior Advisor to State Treasurer Frerichs, Marty McCormack.

Neighborhood Revitalization Coalition (NRC) Meeting

The Small Business Advocacy Council, alongside a dedicated coalition of stakeholders, has united with a common goal: to revitalize, empower, and connect commercial corridors within Cook County, ushering our community into a thriving economic future. This collaborative initiative is driven by grassroots engagement, impactful policy advocacy, and educational initiatives. The Neighborhood Revitalization Coalition (NRC) is crucial in advancing policies that benefit small businesses across the city. To learn more about the NRC or get involved, click HERE (NRC).

Prescription Drug Affordability Board Town (PDAB) Hall

The SBAC joined policymakers and advocates at a town hall discussing legislation aimed at reducing the excessive cost of prescription drugs. High insurance premiums remain a barrier for small businesses trying to provide quality health coverage for their employees. The town hall shed light on proposed legislation that would offer much-needed relief. Representatives Nabeela Syed, Terra Costa-Howard and Senator Mary Edly-Allan were present to field questions and respond to concerns. Learn more about our work on PDAB here!

Small Business Roundtable with Senator Preston

Senator Preston invited the SBAC to participate in a community roundtable alongside Greater Englewood Chamber Executive Felicia Slaton-Young, Greater Auburn-Gresham Development Corporation Director Carlos Nelson, and other leaders to discuss strategies, specifically the 2025 agenda and how to assist and strengthen small businesses in the 16th Senate District.

Midway Chamber Membership Meeting

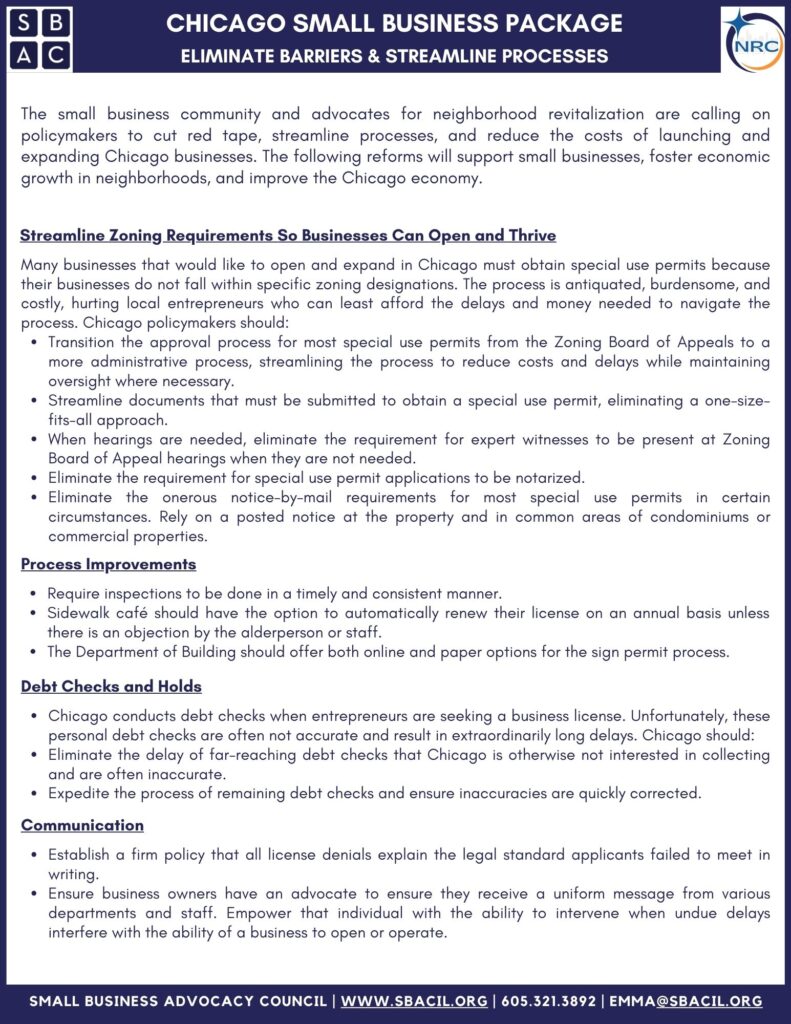

The SBAC was pleased to join the Midway Chamber of Commerce Membership Meeting to discuss the Chicago Small Business Package and other initiatives focused on eliminating barriers and creating new opportunities for small businesses in Chicago. Read more about the Chicago Small Business Package here.

UBC / SBAC Lunch & Learn

Tax Credits & Financial Opportunities for Small Businesses

The SBAC along with Uptown Chamber hosted an informative lunch discussion reviewing possible tax credits and other financial opportunities/incentives for small businesses. This event, moderated by the SBAC's Elliot Richardson, highlighted programs such as the tax credit for hiring formerly incarcerated individuals and ways to access capital. To learn more on possible opportunities, visit the SBAC's Grant and Incentives page.

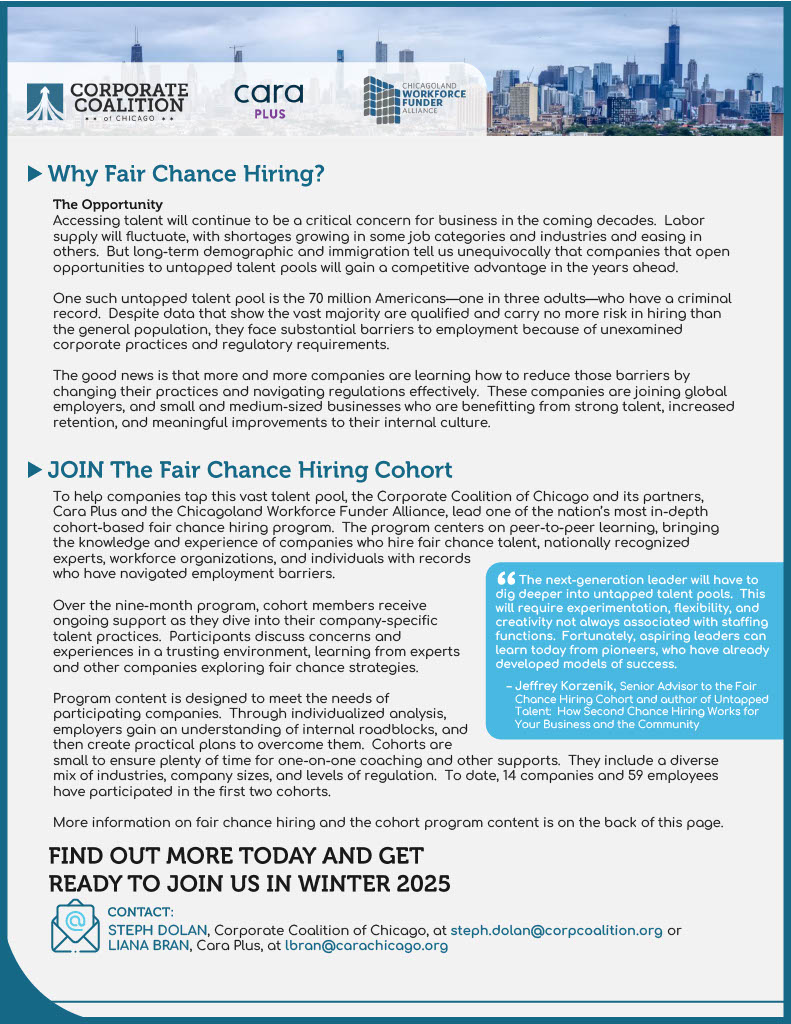

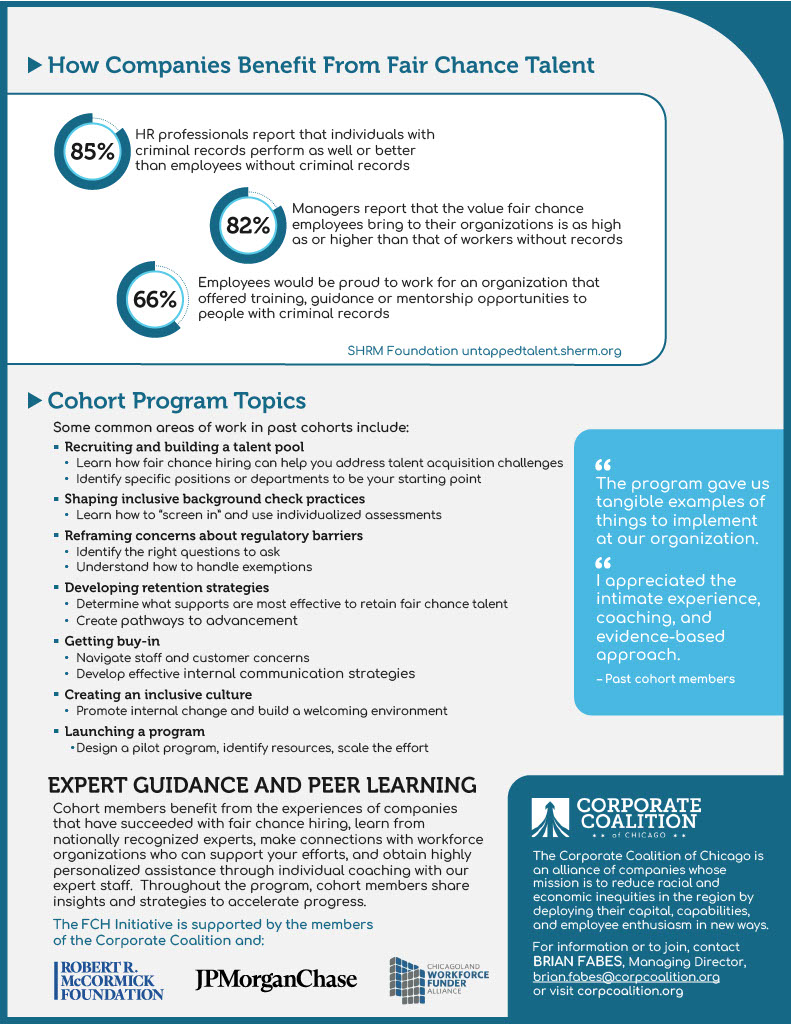

Calling all employers: Third Fair Chance Hiring Cohort launching in Winter 2025!

Join the Fair Chance movement and a growing network of business leaders that recognize the benefit of hiring justice-impacted individuals.

What we do: We work with companies to hire, retain, and advance justice-impacted talent (who represent 1 in 3 working-age Americans). We get to know each company's current policies, share best practices, and provide hands-on support to help your organization decide where and how to take action to pursue fair chance hiring.

Why us? Our nine-month programming brings together business leaders, for best practices, customized coaching, and peer learning to support companies on their fair chance journey. We cover topics ranging from revisiting your background check process to recruiting strategies and partnerships, to launching and scaling fair chance hiring pilots - and more.

Who should join? If your company wants to pursue fair chance hiring and is looking for support to bring this goal to life, this cohort is for you! We ask that employers come ready and eager to (1) share their goals, successes, and challenges with each other and (2) actively identify and drive HR and organizational changes to hire this talent pool.

Want to learn more? Reach out to Steph Dolan (steph.dolan@corpcoalition.org) and Liana Bran (lbran@carachicago.org) to hear why businesses are pursuing fair chance talent and learn more about our program, opportunities to take action, and results from our previous cohorts. You can also learn more here.

Breaking Barriers: How Tax Incentives Empower Employers to Hire Reentry Populations and Transform Communities

"The passage of the $1,500-$7500 tax incentive for employers to help subsidize hiring people from reentry populations is a great way to help integrate people who are highly motivated populations excited to get their lives back on track who are ready to become productive members of society in a meaningful way. As a lifelong champion for the cause and pioneering partner with state and county criminal systems in providing housing, and services including workforce training and employment for tens of thousands of reentry populations since 1994, this tax incentive will undoubtedly help overcome one of the biggest barriers they face to mainstreaming back into our communities - landing a job. As an employer, who has hired hundreds of people with criminal justice backgrounds during my time as a nonprofit employer serving the homeless, I believe that the work ethic, enthusiasm, and eagerness they bring to their jobs to help their customers and employers grow will in most cases break the stigma associated with reentry populations and even surpass expectations of almost every employer willing to take a chance on taking advantage of this program. It's a win/win/win and I believe that over time the data will show that perhaps this tax incentive will serve as one of the most important missing links needed to close the gap and solve the root causes of crime and violence and the high recidivism and costs associated with these issues happening in our cities".

-Neli Vazquez Rowland, President of GOLZ, LLC and Co-Founder and former President of A Safe Haven Foundation.

Learn more about this tax credit here!

The Small Business Advocacy Council and NAWBO Chicago are hosting a special Legislative Panel Discussion on Thursday, September 26th, at 8:30 AM, at Hera Hub Chicago (405 W Superior Street, Room 200C).

Our engaging panel will feature prominent state legislators, including State Representative Robyn Gabel, State Senator John Curran, and State Senator Laura Fine, with Stephanie Posey, Attorney at Posey Law Group LLC, serving as the moderator. The discussion will focus on critical issues impacting women-owned businesses in Illinois.

Seating is limited so register today to secure your spot—tickets are just $20! Click here to sign up or scan the QR code in the flyer.

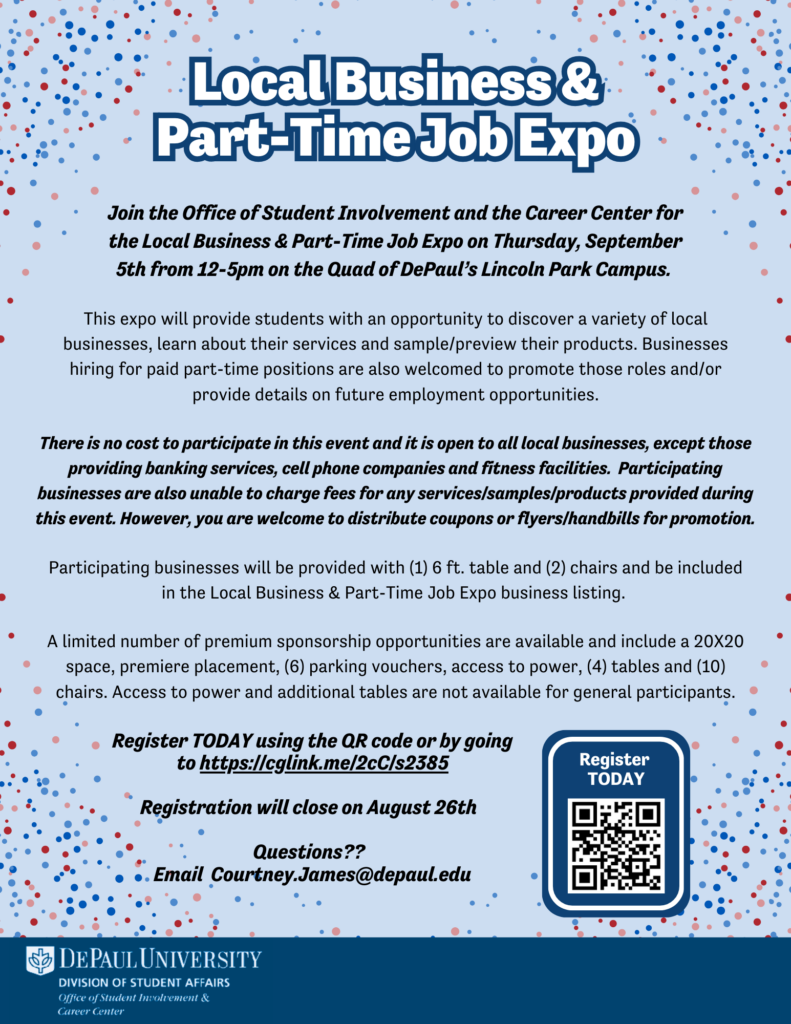

Do you own a small business struggling to find talent? Are you responsible for hiring employees at your company? Do you want to connect with outstanding students and future industry leaders from DePaul University?

DePaul University is hosting its upcoming Local Business & Part-Time Job Expo on Thursday, September 5th, from 12-5 pm. This event will be held on the Quad of DePaul’s Lincoln Park Campus, offering an excellent opportunity for students and local businesses to connect. Not only will this provide businesses an opportunity to attract talented students for future employment opportunities, they will also be visible to the DePaul University community!

We are thrilled to support this event and help facilitate connections between local businesses and the next generation of talent. Registration for the expo will close on August 26th, so be sure to secure your spot soon. Learn more and register here!

SBAC Updates

Financial Growth Opportunities

Running a business is hard and small business owners often do not have time to navigate grants, tax credits, and other funding opportunities. We are excited to help. While we cannot cover everything, we will do our best to keep you current on economic incentives that may be available for your business in 2025!

** It's essential to note that application deadlines for the grants are indicated by dates within the titles of the drop-down menu, ensuring a clear understanding of timelines associated with each opportunity. **

Rolling

The purpose of Community Development Block Grants for Economic Development to assist communities

attract or expand private businesses. The program provides financial assistance in the form of a grant to

the local government for the benefit of private businesses that create or retain jobs primarily for low-to-

moderate income workers. Grants may also be used to support public infrastructure improvements to

support economic development as an indirect benefit to a private business. The Economic Development

component funds are available on an as-needed basis throughout the year to all eligible applicants

meeting program component requirements until all funds allocated to this component have been

distributed.

Learn more about the Community Development Block Grant Economic Development ProgramHERE.

This Notice of Funding Opportunity sets forth the requirements for funding the Returning Residents

Program (20 ILCS 730/5-50), as specified by the Energy Transition Act as part of the Climate and

Equitable Jobs Act, P.A. 102-662 ("CEJA").

Investments in clean energy technology and infrastructure, funded through CEJA and other state and

federal funding sources, will generate significant construction, installation, maintenance, and repair

activity in Illinois. Historically, these investments have not benefited all Illinois communities and workers.

The Returning Residents Program is one of several programs created by CEJA to rectify these historical

inequities.

Learn more about the Illinois Returning Residents Clean Jobs Program HERE.

To address the need to maintain and expand access to care, the Illinois Reproductive Health Facilities

Capital Grant Program will help abortion providers in Illinois address their needs for capital investment.

Grant funds may be used to invest in facility construction or durable equipment. Projects could include:

- New construction, renovation, or major repairs that facilitate expansion or continuation of

pregnancy-related medical services - Investment in new or upgraded equipment that improve care quality or facility capacity,

including medical devices or vehicles for mobile care units - Investment to upgrade or enhance security (barriers, alarm/surveillance systems, etc.)

Award amounts for eligible projects may range from $50,000 to $500,000. Grant recipients must provide a

15% total project cost match.

Learn more about the Illinois Reproductive Health Facilities Capital Grant Program HERE.

The Community Development Block Grant (CDBG) Program was established by the federal Housing and

Community Development Act of 1974 (Act). Administered nationally by the U.S. Department of Housing

and Urban Development (HUD), the Act combined eight existing categorical programs into a single block

grant program. In 1981, Congress amended the Act to allow states to directly administer the block grant

for small cities. At the designation of the Governor, the Department of Commerce and Economic

Opportunity (Department) assumed operation of the State of Illinois CDBG – Small Cities Program in the

same year. Through this program, funds are available to assist Illinois communities to meet their greatest

economic and community development needs, with an emphasis on helping persons of low-to-moderate

income.

The Economic Development grant provides funds year-round to local governments, supporting projects that create or retain permanent jobs and attract private investment. Funding is based on project feasibility, need, and demonstrated benefits to low-to-moderate-income individuals.

Learn more about the CDBG Economic Development Program HERE.

Grants are available for business properties in specific TIF districts

Rollout periods based on TIF districts

Grant provides small businesses with money to property repairs

This is a grant program for black-owned small businesses anywhere in the U.S.

Applicants can receive between $500-$2,000 to help toward business initiatives

Applications do not have a deadline

Grants fall into three categories: Small, Medium, and Large

Currently says that application are not open, but will reopen in 2025

Grant is given for variety of reason that can include small business initiatives

February

Applicants can receive up to $250,000 for small business and cultural initiatives

Applicants must be business that are located on West, Southwest, and SouthSide commercial

corridors

Learn more about the Chicago Neighborhood Opportunity Fund HERE.

April

The 2024 Office of Economic Equity & Empowerment (“OE3”) Small Business Capital and Infrastructure

Grant Program builds upon the success of the 2019 Capital Grant Program. Based on the immense need

for assistance for businesses of all sizes and types and the Administration’s commitment to equity, this

program is designed to help small businesses strengthen their operations, overcome financial challenges,

and continue contributing to their communities and Illinois' economy through capital and infrastructure

investments.

The objective of this NOFO opportunity is to equip businesses with resources to create jobs, build capacity,

scale operations, and increase revenues, while reaffirming the Department’s dedication to advancing

equitable access to opportunities and resources for all Illinois communities.

Learn more about the Capital and Infrastructure Grant Program HERE.

Grant money can be used in whatever way Founders need to use it - like seeking professional assistance with preparing documents to qualify for funding

Complete full application which includes information about your business and a short 1-3 minute pitch video.

Learn more about the National Pride Grant for LGBTQIA+ Small Businesses HERE.

May

Grant money can be used in whatever way Founders need to use it - like seeking professional assistance with preparing documents to qualify for funding

Complete full application which includes information about your business and a short pitch video

Learn more about the Kitty Fund Mompreneur Business Grant HERE.

June

This program aims to support businesses undertaking large-scale capital investment projects that pledge to create significant job opportunities for Illinois residents during their relocation or expansion within the state. The Business Attraction Prime Sites grants cover a variety of economic development initiatives, including infrastructure improvements and capital equipment purchases, all designed to foster job creation in Illinois.

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are competitive federal grants that offer funding opportunities for small businesses to conduct research and development (R&D) on innovative technologies relevant to federal agencies. These grants support the exploration of cutting-edge products with high commercialization potential. Our program provides a state match for businesses that have already received SBIR or STTR awards, helping them further develop and bring their high-tech innovations to market.

This program supports businesses making substantial capital investments and creating jobs in Illinois through relocation or expansion. Eligible applicants must be expanding in Illinois, qualify for EDGE, HIB, REV, or MICRO credits, and commit to hiring at least 40 new Illinois residents with a $40M investment, or 100 residents with a $20M investment. Priority is given to businesses in key industries like Agribusiness, Energy, IT, Healthcare, Manufacturing, and Transportation.

Learn more about the Clean Jobs Workforce Network Program HERE.

December

The Illinois Grocery Initiative Equipment Upgrades Program, authorized by Public Act 103-0561, will

provide grants for new energy-efficient equipment upgrades for existing independently-owned for-profit

grocery stores, cooperative grocery stores, or not-for-profit grocery stores.

While the Illinois Grocery Initiative is intended to reduce or eliminate the existence of "food deserts" in

Illinois and will prioritize stores located in food deserts, the Equipment Upgrades Program is not limited to

establishments located in food deserts. These grants are intended, however, to facilitate energy-efficient

equipment investment and sustainability for stores located in food deserts, areas that could become food

deserts, and other areas that are underserved to a lesser degree. These grants will reimburse costs for

the purchase and installation of new energy-efficient equipment.

Still curious about how to get approved for a Small Business Grant?

Investopedia has a great article on the ins and outs of applying for and qualifying for a small business grant!

Incentives and Tax Credits

The new law boosts the tax credit for businesses hiring formerly incarcerated individuals from 5% to 15% of qualified wages, increasing the maximum credit from $1,500 to $7,500. These funds can be used for workforce transition and on-the-job training, supporting the Illinois economy by reducing reincarceration costs and generating long-term revenue through taxes. Stably employed individuals returning from incarceration have a 62% lower risk of recidivism, enhancing public safety. The General Assembly has allocated $1,000,000 to this program, so small businesses should act now to supplement their workforce. Stay tuned for updates on how to apply for the tax credit!

Illinois has taken a significant step forward with the passage of HB4951, becoming the 12th state in the nation to implement a Child Tax Credit. This new measure offers crucial tax relief to working families with low to moderate incomes, particularly those with young children. Starting in 2024, taxpayers who qualify for the Illinois Earned Income Tax Credit (EITC) and have at least one child under 12 will be eligible for a Child Tax Credit worth 20% of their EITC. This amount will increase to 40% for the 2025 tax year and beyond, providing ongoing support to help offset the high costs of raising children.

The Illinois Angel Investment Tax Credit Program encourages investment in innovative, early-stage companies to help obtain the working capital needed to further the growth of their company in Illinois. Investors in companies that are certified as Qualified New Business Ventures (QNBVs) can receive a state tax credit equal to 25% of their investment (up to $2 million).

Learn more about the Illinois Angel Investment Tax Credit Program HERE.

The data center’s investment program provides owners and operators with exemptions from a variety of state and local taxes for qualifying Illinois data centers. The program also provides data center owners and operators with a tax credit of 20% of wages paid for construction workers for projects located in underserved areas.

The Illinois Enterprise Zone Program is designed to stimulate economic growth and neighborhood revitalization in economically depressed areas of the state through state and local tax incentives, regulatory relief, and improved governmental services. Businesses located or expanding in an Illinois enterprise zone may be eligible for the following state and local tax incentives.

The River Edge Redevelopment Zone Program (RERZ) helps revive and redevelop environmentally challenged properties adjacent to rivers in Illinois. The River Edge Redevelopment Zone Act authorizes the Illinois Department of Commerce to designate zones in five cities: Aurora, East St. Louis, Elgin, Peoria, and Rockford.

RERZ provides several incentives authorized by State law. Two of these – sales tax exemption and property tax abatement (if offered in the zone) – are administered by the local zone administrators. The others involve tax incentives that are claimed on your Illinois Income Tax filing forms.

Illinois’ EDGE program provides annual corporate tax credits to qualifying businesses which support job creation, and capital investment and improve the standard of living for all Illinois residents. Initial qualification criteria require certain job creation and project investment.

Learn more about the Economic Development for a Growing Economy Tax Credit Program (EDGE) HERE.

This program supports large-scale economic development activities by providing tax incentives (similar to Enterprise Zones) to companies that make substantial capital investments in operations and create or retain an above-average number of jobs. Businesses may qualify for: investment tax credits, potential High Impact Business construction jobs credit, a state sales tax exemption on building materials and/or utilities, a state sales tax exemption on purchases of personal property used or consumed in the manufacturing process or in the operation of a pollution control facility.

Learn more about the High Impact Business Program (HIB) HERE.

Created as part of the Tax Cuts and Jobs Acts of 2017, Opportunity Zones provide an incentive for investors to invest in Opportunity Zones for a temporary tax deferral. Opportunity Zones are areas in Illinois that need investment to help create jobs and investment in areas that need it most. Opportunity Zones were created in 2018 through an analysis that included poverty rates, unemployment rates, the total number of children in poverty, violent crime rate, and population.

The Business Attraction Prime Sites Capital Grant Program assists companies with large-scale capital investment projects that commit to significant job creation for Illinois residents as they relocate or expand operations within Illinois. Prime Sites grants can encompass a wide range of economic development projects that will result in job creation in the state of Illinois.

Award amounts for eligible projects will be formula-based, and an applicant may apply for a grant of up to $10,000 per new job created. Grants will range from $250,000 to $25 million. This grant opportunity also includes a 4:1 match requirement, meaning grant funds can only cover 20% of the total eligible capital expenses for the proposed project.

Learn more about the Business Attraction Prime Sites Capital Grant Program HERE.

Employers are allowed a tax credit for qualified educational expenses associated with qualifying apprentices. Employers may receive a credit of up to $3,500 per apprentice against the taxes imposed by subsections (a) and (b) of Section 201 of the Illinois Income Tax Act, and an additional credit of up to $1,500 for each apprentice if (1) the apprentice resides in an underserved area or (2) the employer's principal place of business is located in an underserved area.

Learn more about the Illinois Apprenticeship Education Expense Tax Credit Program HERE.

WOTC (Work Opportunity Tax Credit) is a federal tax credit available to employers who hire and retain veterans and/or individuals from other target groups with significant barriers to employment. Employers claim about $1 billion in tax credits each year under the WOTC program.

What Workers can Employers Claim WOTC for?

- Veterans

- Temporary Assistance for Needy Families (TANF) Recipients

- Supplemental Nutrition Assistance Program recipients (also known as SNAP or food stamps)

- Designated Community Residents (living in Empowerment Zones or Rural Renewal Counties)

- Vocational Rehabilitation Referral

- Ex-felons

- Supplemental Security Income (SSI) Recipients

- Summer Youth Employee (living in Empowerment Zones)

- Long Term Unemployed (LTUR)

Learn more about the Work Opportunity Tax Credit (WOTC) HERE.

Provide businesses with sustainable, no-cost, and low-cost strategies to recruit, train, and retain the skilled workforce needed to thrive. Your partnership with DRS gives you access to our qualified vocational rehabilitation professionals. DRS provides job analysis, job coaches, training, and job accommodations/technical assistance.

There are several financial incentives that are available to businesses that hire individuals with disabilities. DRS can help you take advantage of these:

- On the Job Evaluations (OJE) are wages reimbursed to the employer for evaluating if an individual with a disability can perform the duties of a certain job.

- On the Job Training (OJT) reimburses an employer a negotiated wage if an individual with a disability that they hire needs certain kinds of training.

- Work Opportunity Tax Credits (WOTC) provides a tax credit for employers who hire certain targeted low-income groups, including vocational rehabilitation candidates and Social Security Administration (SSI/SSDI) recipients.

The River Edge Historic Tax Credit Program offers a 25% state income tax credit for qualified expenditures on certified historic structures within River Edge Redevelopment Zones (Aurora, East St. Louis, Elgin, Peoria & Rockford). This initiative, extended until December 31, 2021, aims to boost Illinois' economy by creating jobs through substantial rehabilitation projects. Recent changes in the Historic Preservation Tax Credit Act have transferred program administration to the Department of Natural Resources since January 1, 2019, fostering the revitalization of historic structures and neighborhoods.

Learn more about the Illinois Historic Preservation Tax Credit Program HERE.

Discover Illinois as a premier hub for film, TV, and advertising production! Explore diverse locations, from Chicago's skyline to historic neighborhoods. With stunning landscapes and a thriving industry, Illinois provides a 30% Film Tax Credit, making it a top choice for filmmakers and creatives.

The REV Illinois Act is a competitive incentives program aimed at boosting clean jobs in Illinois by attracting companies in the electric vehicle and renewables sectors. It supports the state's climate change goals, including achieving 100% clean energy by 2050 and putting one million EVs on the road by 2030. The program offers incentives for manufacturing electric vehicles, batteries, charging infrastructure, recycling products, and renewables like solar, wind, and energy storage. Benefits range from twenty to thirty years, including tax incentives, training credits, grants, and equipment/capital cost exemptions.

Learn more about the Reimagining Energy and Vehicles (REV) Illinois Program HERE.

The Business Attraction Prime Sites Capital Grant Program in Illinois supports companies undertaking significant capital investment projects that commit to creating jobs for residents within the state. Eligible projects range from new construction to renovation of industrial and commercial facilities, excluding warehouses. Grants, ranging from $250,000 to $25 million, are formula-based with a maximum of $10,000 per new job created. There's a 4:1 match requirement, limiting grant funds to cover only 20% of the total eligible capital expenses for the project.

Learn more about the Business Attraction Prime Sites Capital Program HERE.

Discover the benefits of WOTC (Work Opportunity Tax Credit) – a federal program offering employers tax credits of up to $1 billion annually for hiring and retaining veterans and individuals facing employment barriers. The credit amount varies based on factors like the hired individual's target group, first-year wages, and hours worked, with a maximum limit on the tax credit. Take advantage of this opportunity to support diverse hiring and boost your business.

Learn more about the Work Opportunity Tax Credit (WOTC) HERE.

Illinois is launching the Advantage Illinois – SSBCI 2.0 Program with $220 million to aid small businesses. The initiative prioritizes equitable support, utilizing outreach partners to engage historically marginalized groups like Socially and Economically Disadvantaged Individuals (SEDI) and Very Small Businesses. The program, guided by the U.S. Department of the Treasury, aims to address barriers these groups face in accessing capital.

Advantage Illinois under SSBCI 2.0 will offer two programs and must result in job creation or retention at the project location.

- Participation Loan Program (PLP) (presentation) – helps Illinois businesses get term loan financing at lower rates by purchasing a portion of the loan and lowering the risk for the lenders.

- Loan Guarantee Program (LGP) – provides a guarantee of partial principal repayment to the lender if a loan goes into default.

The Illinois Innovation Venture Fund (INVENT) is a $114 million equity capital program supported by the U.S. Department of the Treasury's State Small Business Credit Initiative (SSBCI) and managed by the Illinois Department of Commerce and Economic Opportunity (DCEO). This initiative aims to break down barriers for founders and communities that have struggled to access capital. The fund prioritizes small businesses, Capital Disadvantaged Business (CDB) owners, socially and economically disadvantaged individuals (SEDI), and industries aligned with the state's economic development plan. The goal is to foster sustainable growth, enhance access to capital, and support traditionally underserved entrepreneurs.

Learn more about the Illinois Innovation Venture Fund (INVENT) HERE.

This new program will be overseen by DCEO and administered by the Illinois Finance Authority (IFA), which will partner with local lenders to issue the loans. As Illinois officially designated “Climate Bank”, IFA will be exclusively focusing on providing its SSBCI-supported financing for the start-up and/or expansion of ventures directly involving environmentally supportive, “green” businesses, including those that address the adverse impacts of climate change.

Learn more about the Climate Bank Finance Participation Program HERE.

Additional Resources:

- Agricultural Justice Project (AJP), a program offering free resources and guidance for owners of farms and food businesses.

- Funding options for Black-owned businesses, including venture capital firms and programs offering financing to Black entrepreneurs.

- Funding options for LGBTQ+-owned businesses, including resource networks and organizations that offer grants to LGBTQ+ entrepreneurs and those from other underrepresented backgrounds.

- Funding options for Hispanic-owned businesses, including funding sources and organizations aimed at supporting Latinx and Hispanic entrepreneurs.

- Funding options for minority-owned businesses, including multiple grants, funding sources, and low-cost loans that are intended to help minority-owned businesses grow.

- Funding options for veteran-owned businesses, from government-backed programs to pitch competitions and business accelerators.

- Funding options for women-owned businesses, including ten programs, agencies, and organizations that are helping women entrepreneurs be better represented in the ranks of American business owners.

- SBA Small Business Development Centers, can help companies of all kinds locate additional funding opportunities at the national and local level.

We’re excited to share some insightful articles from our valued partner, Saul Ewing LLP, that cover important developments in employment law and regulatory updates. These resources provide valuable information for our SBAC members and are a great way to stay informed about recent legal changes and their potential impact on your business.

- Texas Court Invalidates FTC Ban on Non-Compete Agreements

- This article discusses a recent Texas court decision that invalidated the Federal Trade Commission's ban on non-compete agreements, offering insights into how this ruling could influence non-compete practices in other states.

- Amendment to Illinois Human Rights Act Prohibits Discriminatory Use of AI

- Learn about the recent amendment to the Illinois Human Rights Act that addresses the discriminatory use of artificial intelligence in employment decisions, and what it means for businesses using AI tools.

- Appellate Court Sticks a Fork in the DOL’s 80/20 Rule

- This article covers the appellate court's decision to strike down the Department of Labor’s 80/20 rule, which impacts the classification of tipped employees and their compensation.

- NLRB Decision Finds Overly Broad Non-competition and Non-solicitation Clauses Violate NLRA

- Discover how the National Labor Relations Board’s recent decision affects the enforceability of non-competition and non-solicitation clauses under the National Labor Relations Act.

- Beating the Heat – OSHA’s Newly Introduced Proposed Heat Hazard Rule

- Stay up to date with OSHA’s proposed new rule addressing heat hazards in the workplace, and what steps businesses should take to comply with these potential changes.

- Key Illinois Employment Law Changes Taking Effect July 1, 2024

- This article highlights the key changes to Illinois employment law that will take effect on July 1, 2024, including new regulations and requirements that could affect your business operations.

We encourage you to explore these articles for a deeper understanding of these important legal topics. Stay informed and ahead of the curve with these crucial updates!

From Adversity to Achievement:

Celebrating the Journey of Growth and Company Milestones of SpeedPro Loop Chicago

SpeedPro Chicago Loop’s Rebecca Considine is a wonderful and valued Small Business Advocacy Council’s Board of Advisors member. We are excited to celebrate Rebecca, SpeedPro Chicago Loop founder Eric Lazar, and the company in this blog. Considering the SBAC was the very first organization SpeedPro Chicago Loop joined when they launched their studio in 2015 and given Eric and Rebecca’s important contributions to the SBAC, we are excited about how the company has grown since – especially considering the company was teetering on the brink of closure before ever even opening its doors. The challenges the company faced were immense, but now, the SBAC is proud to see one of its supporters go from nearly bankrupt to highly profitable.

Of note, SpeedPro Chicago Loop was The International Franchise Association’s 2022 ‘Franchisee of the Year’ and also most recently recognized by both Inc. 5000 Regionals: Midwest list of Fastest Growing Companies and the Printing Impressions 150 List Largest Wide Format Printers in North America, a testament to the incredible growth they have achieved over the past nine years. With a two-year revenue growth of 106%, they earned their spot as one of the fastest-growing private companies in the Midwest.

But their journey certainly didn't start with accolades and recognition. It began with a vision to merge advertising and marketing expertise with a culture of innovation and community engagement, a vision that being an SBAC Business Supporter helped them achieve. As a Marine Corps veteran with more than 25 years of private sector experience, Eric wanted to leverage the sales strategies he learned working at broadcast television stations and working in the mobile technology industry. SpeedPro Chicago Loop was born out of a desire to channel that experience into something meaningful and impactful.

At the heart of the company’s success is their continued commitment to excellence and customer satisfaction. They’ve cultivated partnerships, driven operational excellence, and embraced community engagement every step of the way. From being the only two-time recipient of Project of the Year by SpeedPro corporate to consistent acknowledgment as a ‘3-Best Sign Shops in Chicago’ for seven consecutive years, they’ve always strived for greatness.

SpeedPro Chicago Loop is committed to giving back to the community, including when the company distributed inspirational signs across Chicago to show support for frontline workers and first responders during Covid. Proceeds from the signs were donated to The American Red Cross. As mentioned above, SpeedPro Loop Chicago is also extremely supportive of the SBAC and small business community.

As we all know, it isn’t easy being a small business owner. There will be days filled with challenges, setbacks, and seemingly insurmountable obstacles. But amidst the trials, there are moments of great reward – the satisfaction of seeing a vision come to life and the pride of making a positive impact on the lives of customers and those around us. SpeedPro Chicago Loop is an outstanding example of the greatness our Business Supporters can achieve with grit, perseverance, and dedication.

January 2024

Authored by: David G. Shapiro and Marielle C. MacMinn

SBAC Partner, Saul Ewing, provides an update on dubious Employee Retention Credit (ERC) claims - "many of which were made at the urging of aggressive promoters. The IRS is offering a limited-time Voluntary Disclosure Program (VDP) to encourage taxpayers to come forward, allowing taxpayers to keep some of the refunds received and offering to waive penalties and interest, in exchange for the taxpayers identifying the promoters involved in their ERC applications. All VDP applications must be submitted by March 22, 2024."

Learn more about what you need to know here --> IRS Announces Voluntary Disclosure Program for Employee Retention Credit Claims: Good News for Businesses That May Have Claimed the Credit in Error | Saul Ewing LLPWhat You Need

Did you miss it?

We had a great time at George Street Pub for the SBAC's annual Holiday party. Wow - what an incredible turnout - busting out the venue with almost 100 folks! Thank you for coming to celebrate the SBAC and its work in the Illinois communities. We are excited to watch 2024 be even better!

If you'd still like to support but missed the party?

And a few pics from the party...

Insights Archive

Common Sense Licensing Reform

SBAC INSIGHTS PAGE COMMON-SENSE LICENSING REFORM There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also…

DHBL article: Politicians should embrace these New Year’s resolutions January 2025

SBAC INSIGHTS PAGE Politicians should embrace these New Year’s resolutions Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses’ success. However, this year much more must be done to create…

Small Business Impacts of New Rules

SBAC INITIATIVES PAGE Small Business Impacts of New Rules Find and Contact Your Elected Officials HERE! Resources & Fact Sheets Expand Download Quick Fact Sheet Download One-Pager

Oktoberfest war ganz Spaß!

(Oktoberfest was really fun!)

If you missed our event and would like to contribute to the SBAC, please click on the button to the right. The SBAC works diligently to advance policies that support small businesses, their employees and the revitalization of neighborhoods.

***The Small Business Advocacy Council has been determined to be an organization which is exempt from income tax under IRC Section 501(c)(6). Please consult your tax advisor about the deductibility of your contribution(s) for income tax purposes.

Prefer to mail a check?

Please indicate your contribution designation and mail to:

Small Business Advocacy Council

3033 N Clark Street

Chicago, IL 60657

Insights Archive

Insights + News

This is a crucial time for lawmakers to support policies that will revitalize neighborhood business districts and support Chicago small businesses. Therefore, we have formed a neighborhood revitalization caucus where politicians from various facets of government can come together, collaborate with stakeholders, and work to revitalize local economies.

We are very thankful to the following policymakers for their interest in participating in the caucus:

- Senator Lakesia Collins

- Senator Mike Simmons

- Representative Lilian Jimenez

- Representative Margaret Croke

- Representative Lindsey LaPointe

- Representative Hoan Huynh

- Representative Kimberly Du Buclet

- Alderman Jason Ervin

- Alderman Lamont J. Robinson

- Alderman Scott Waguespack

- Alderwomen Leni Manaa-Hoppenworth

- Alderwomen Jessie Fuentes

- Alderman Bennett Lawson

- Alderman Matt Martin

- Alderman Desmon Yancy

- Alderman Matt O'Shea

- Alderman Andre Vasquez

- Alderman Walter Burnett Jr.

- Alderman Derrick Curtis

- Alderman Gilbert Villegas

- Alderman William Conway

- Alderwoman Angela Clay

- BACP Commissioner Kenneth Meyer

We look forward to working with these policymakers to revitalize neighborhood business districts and support local businesses.

Insights Archive

Common Sense Licensing Reform

SBAC INSIGHTS PAGE COMMON-SENSE LICENSING REFORM There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also…

DHBL article: Politicians should embrace these New Year’s resolutions January 2025

SBAC INSIGHTS PAGE Politicians should embrace these New Year’s resolutions Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses’ success. However, this year much more must be done to create…

Small Business Impacts of New Rules

SBAC INITIATIVES PAGE Small Business Impacts of New Rules Find and Contact Your Elected Officials HERE! Resources & Fact Sheets Expand Download Quick Fact Sheet Download One-Pager

Insights + News

We're excited to announce a series of free community town halls focusing on policies that help revitalize neighborhood business districts and support small businesses. These town halls are designed to be informative, and interactive, and to bring communities together. Members and business owners are encouraged to further learn how the SBAC and a coalition of engaged stakeholders have been working to revitalize neighborhoods throughout Chicagoland.

Because we know our community is located throughout the state of Illinois, we have chosen a few locations throughout the city to make access more convenient for you.

Click on one of the boxes below to find one near you and register today!

Insights Archive

Common Sense Licensing Reform

SBAC INSIGHTS PAGE COMMON-SENSE LICENSING REFORM There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also…

DHBL article: Politicians should embrace these New Year’s resolutions January 2025

SBAC INSIGHTS PAGE Politicians should embrace these New Year’s resolutions Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses’ success. However, this year much more must be done to create…

Small Business Impacts of New Rules

SBAC INITIATIVES PAGE Small Business Impacts of New Rules Find and Contact Your Elected Officials HERE! Resources & Fact Sheets Expand Download Quick Fact Sheet Download One-Pager

SBAC partner Fifth Third Bank is committed to the success of small businesses. Because "small" is a misnomer for driving the economy and creating jobs in local communities as they have a "big" impact. Fifth Third partners with small businesses to provide the lending, lines of credit, and technical assistance they need to start, maintain, and grow.

Check out some articles that Fifth Third has written to help drive success.

CINCINNATI, May 2, 2023 /3BL Media/ - Small Business Week 2023 is April 30 to May 6 and Fifth Third Bank, National Association, is proud that it can offer local small businesses guidance, products, and services at every stage of the business lifecycle...

WASHINGTON — As aggressive marketing continues, the Internal Revenue Service today renewed an alert for businesses to watch out for tell-tale signs of misleading claims involving the Employee Retention Credit...

Insights Archive

Insights + News

The SBAC has significantly impacted the small business community since 2010. From reducing LLC fees to championing legislation focused on reducing premiums for small businesses and increasing transparency to understand better what drives health insurance costs.

Our mission has always been to fight alongside small business advocates to enact policies that support small businesses, their employees, and our economy. And we love when our community responds to us in words or videos. It means the world to us and keeps the momentum going as we continue to secure BIG wins!

With that - check out our new Testimonial page with videos, words of support and a fresh new look.

And if you'd like to add your words of support to the page - there's a link for that too. Thank you for all you do to help us help the small business community. Together we are strong.

Insights Archive

Common Sense Licensing Reform

SBAC INSIGHTS PAGE COMMON-SENSE LICENSING REFORM There are 132 occupational licenses in Illinois. Let’s reflect on that for a moment and consider whether there are ways to protect the safety, welfare, and health of the public without needlessly hurting entrepreneurs and small businesses. The red tape associated with monitoring and enforcing all these licenses also…

DHBL article: Politicians should embrace these New Year’s resolutions January 2025

SBAC INSIGHTS PAGE Politicians should embrace these New Year’s resolutions Each year, we hope politicians will prioritize and enact policies that support the small business community. Over the past few years, we have scored victories by partnering with legislators who care about small businesses’ success. However, this year much more must be done to create…

Small Business Impacts of New Rules

SBAC INITIATIVES PAGE Small Business Impacts of New Rules Find and Contact Your Elected Officials HERE! Resources & Fact Sheets Expand Download Quick Fact Sheet Download One-Pager